Derrell S. Peel, Oklahoma State University

Cattle and beef markets are undergoing a sharp transition in 2023 with ever-tighter cattle numbers, declining beef production and sharply higher cattle and beef prices. These market conditions are expected to impact international trade of U.S. cattle and beef. Reduced beef supplies and higher prices are projected to lead to reduced beef exports and increased beef imports. The strength of the U.S. dollar and the impacts of exchange rates may further exaggerate or mute these underlying market forces. The relatively strong dollar in recent months has tended to dampen beef exports and support increased imports. Unique market factors in specific countries will also impact trade flows in particular markets. The most recent trade data confirms that the expected impacts are indeed developing.

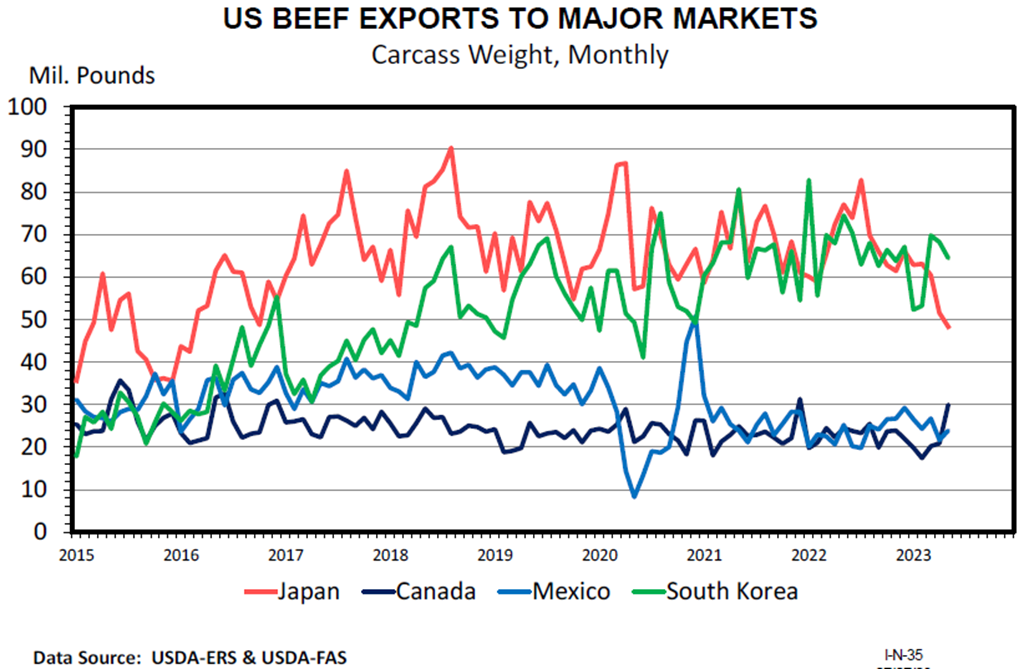

Beef exports in the latest data for May are down 19.9 percent year over year. Total beef exports for the year to date are down 11.4 percent compared to the record pace in 2022. Beef exports began to weaken in late 2022 and have been down year over year each month for the past seven months. Beef exports to Japan were down 36.4 percent year over year in May and are down 13.9 percent for the January to May period compared to last year. Exports to South Korea were down 14.0 percent in May contributing to an 11.3 percent decrease year over year thus far in 2023. For the year to date, South Korea is the largest market for beef exports, ahead of Japan so far this year. China/Hong Kong remains the number three beef export market but is down 9.3 percent for the January to May period following an 11.1 percent year over year decrease in May.

Mexico remains the number four beef export market and is the only major market that is higher, up 10.3 percent year over year for the year to date but was down 5.4 percent in May compared to one year ago. Beef exports to the number five market in Canada were up 22.7 percent in May, holding the year-to-date total to a 3.3 percent decrease compared to last year. Taiwan is the number six beef export market and was up 7.8 percent year over year in May but remains down 16.1 percent for the first five months of the year compared to one year ago.

Total beef imports were up 5.7 percent year over year in May. For the year thus far, beef imports are down a scant 0.6 percent compared to the first five months of last year. Beef imports appear to be reverting to more traditional import patterns with May imports of beef from Australia up 39.1 percent and imports from New Zealand up 23.2 percent for the month. For the January to May period, beef imports from Australia are up 23.9 percent with New Zealand up 9.0 percent year over year. Australia is currently the fifth largest beef import source behind fourth place New Zealand. Canada remains the leading beef import source with May imports down 6.9 percent and a year-to-date total up 2.3 percent. Mexico is the number two beef import source with May imports down 4.1 percent and cumulative imports for the year down 11.9 percent. Brazil is the third largest source of beef imports with May imports down 9.2 percent and total imports down 11.5 percent thus far in 2023. Beef imports will continue to be supported by higher domestic beef prices and the reduction in U.S. processing beef supplies due to reduced cow slaughter.

Cattle imports from Mexico are rebounding sharply from the 15 year low in 2022. Total cattle imports from Mexico for the year thus far were up 49.0 percent in May and are up 37.4 percent for the January to May period. Increased cattle imports from Mexico offsets a 16.5 percent year to date decrease in cattle imports from Canada leading to an 11.1 percent increase in total cattle imports thus far in 2023. Very dynamic U.S. market conditions will continue to impact beef and cattle trade flows for the foreseeable future.